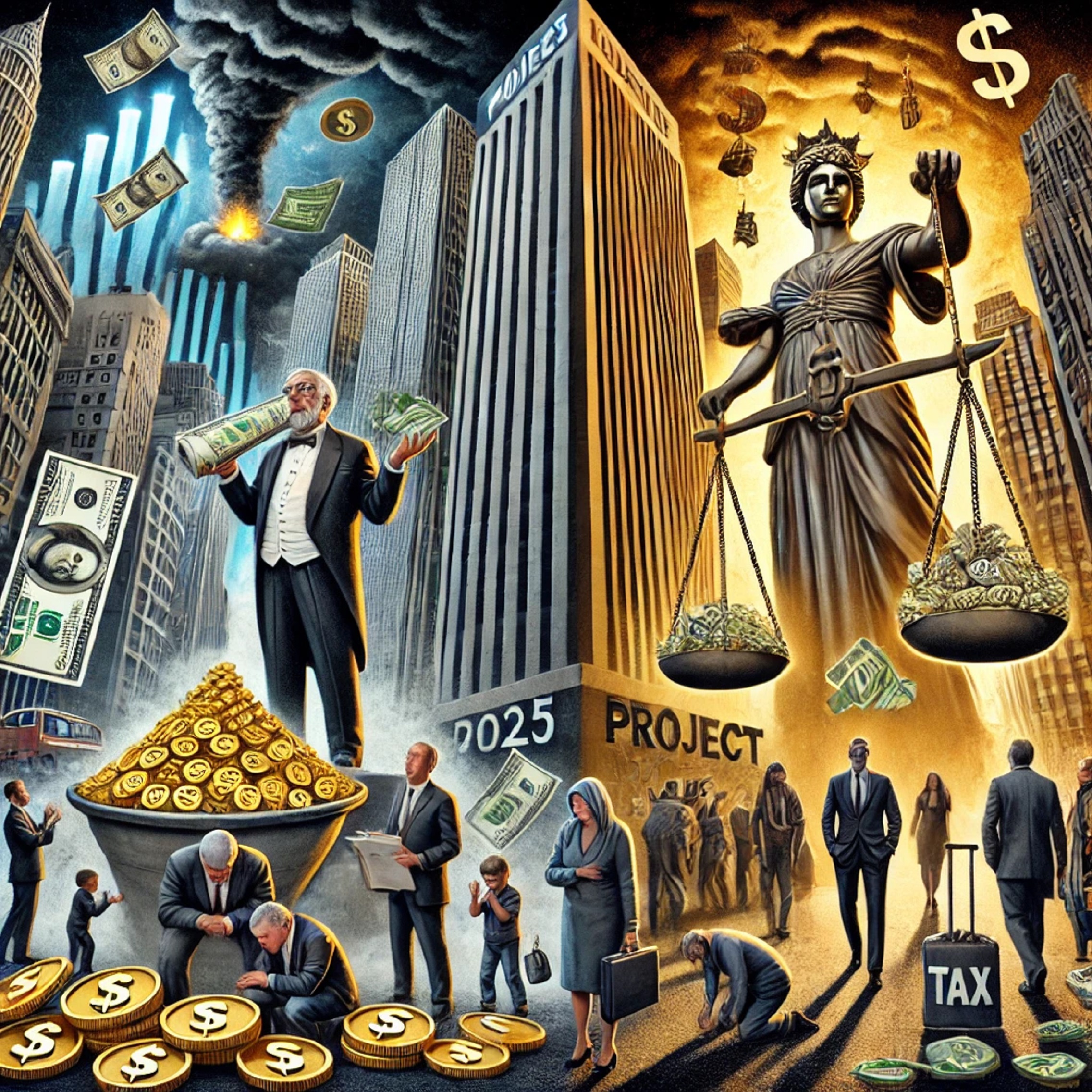

The public has likely heard of Project 2025, the sprawling far-right proposal that aims to radically overhaul how the United States governs its citizens. However, what has received less attention is the devastating tax impact this plan would have on everyone except the ultra-rich.

Project 2025, a 920-plus page blueprint, outlines sweeping changes that threaten to strip away fundamental rights, including those related to personal freedoms, reproductive autonomy, and family structures. It also seeks to hand over key sectors like energy policy to big oil companies and education to private interests. Perhaps most concerning is the way it paves the way for former President Trump’s autocratic ambitions, envisioning a government that aligns with his view of a “dictator on Day One.”

Desi Lydic of The Daily Show aptly describes it as “Conservative fan fiction which could very well become fan reality.” She further notes the discomfort even Trump seems to feel about the plan, quipping, “Apparently it’s getting a little too controversial for Trump, because he’s running away from it like it’s a disabled veteran asking for a selfie.”

Yet, amidst all the controversy, the news has barely scratched the surface of one of the most troubling aspects of Project 2025: its tax proposals. The plan is packed with massive tax breaks, giveaways, and cuts for billionaires and corporations, while simultaneously introducing new taxes that would disproportionately affect the middle and working classes.

Although Trump recently claimed ignorance of the plan, stating he “knows nothing” of it, Project 2025 is built on his own policies and crafted by his former staff and cabinet secretaries. The American public deserves to know the full extent of how these changes could devastate the economy.

Key Tax Changes Under Project 2025:

-

Elimination of Corporate Minimum Tax and Excise Tax on Stock Buybacks: The plan calls for completely abolishing the 15% corporate minimum tax and the 1% excise tax on stock buybacks, both of which currently help ensure that wealthy corporations contribute their fair share.

-

Paralyzing the IRS: By ending enforcement funding from the Inflation Reduction Act, Project 2025 would cripple the IRS’s ability to collect unpaid taxes, which has already brought in over $1 billion in just a short time.

-

Replacing Civil Servants with Political Loyalists: The plan aims to grind the government to a halt by replacing expert civil servants with Trump loyalists chosen solely for their allegiance to him, undermining the efficiency and integrity of government operations.

-

Tax Bracket Changes Favoring the Ultra-Wealthy: The proposed changes would deliver a massive tax cut to the upper brackets, letting the ultra-rich off the hook while increasing the tax burden on working families. A study by the Center for American Progress reveals that under Project 2025:

- A family of four earning $100,000 would pay $2,600 more per year in taxes.

- A family of four earning $5 million would receive a $325,000 tax cut.

Brendan Duke of the Center for American Progress summed it up succinctly: “This shifts taxes from the wealthy to the middle class, full stop.”

Call to Action:

The American people must demand that news networks provide comprehensive coverage of the economic impacts of Project 2025. This isn’t just about protecting our rights; it’s about safeguarding the economic well-being of the middle class and preventing the further concentration of wealth among the ultra-rich.

The plans laid out in Project 2025 represent the most extreme ideas from the far-right movement, and they have never been articulated in clearer or starker terms. As Jordan Klepper of The Daily Show put it, “This is textbook Trump...He doesn’t mind if it’s full of contradictions. He ‘hasn’t read’ Project 2025, but he ‘likes parts of it.’ He has ‘no idea’ who’s behind it, but he hired most of them.”

Now, more than ever, it is crucial to expose these regressive and economically destructive policies. Join the fight to protect the middle class, secure economic prosperity for all, and ensure that the future of America is not dictated by the ultra-wealthy.

Take action now by adding your name to demand that news networks expose Project 2025’s nightmare tax scheme: https://actionnetwork.org/forms/demand-news-networks-expose-project-2025s-nightmare-tax-scheme-now.