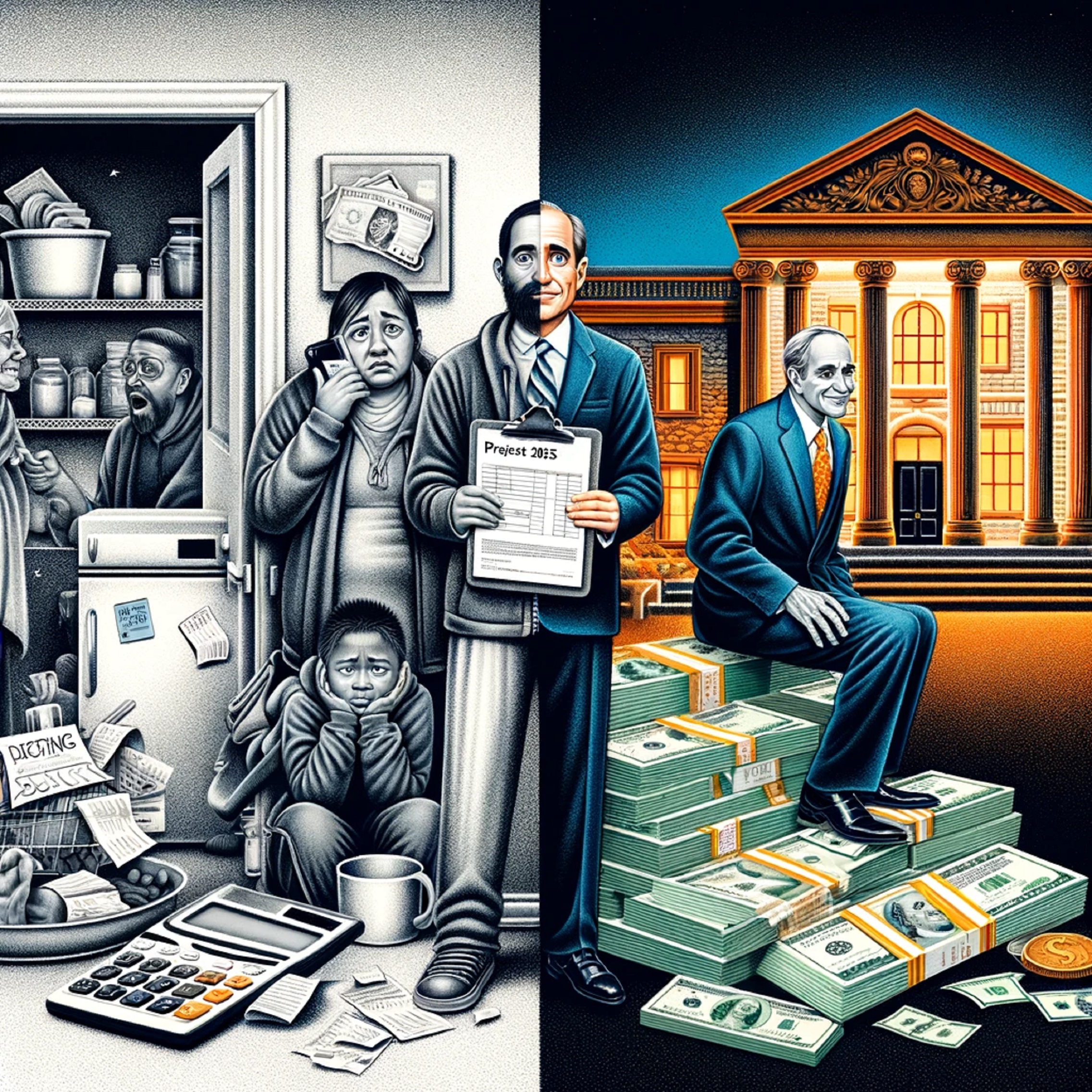

A recent analysis by the Joint Economic Committee has raised alarming concerns about the potential impact of Project 2025 on the U.S. tax code and its far-reaching consequences for the nation’s social safety net and anti-poverty programs. While the health care and education systems have been highlighted as areas under threat, Project 2025 also poses a serious risk to crucial programs that support millions of low- and middle-income Americans.

The analysis reveals that Project 2025 advocates for the elimination of "most tax credits, deductions, and exclusions," without specifying which ones would be cut. This lack of clarity could jeopardize some of the most effective anti-poverty measures currently in place, including the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).

The EITC, the nation’s largest anti-poverty program, provides critical financial support to low-wage workers, both single and married. In the 2024 tax year, a single person with three or more qualifying children making $59,899 could receive a maximum benefit of $7,830. The ripple effects of the EITC extend beyond immediate financial relief; research has shown that children in families who receive a larger share of the EITC are more likely to graduate from high school, obtain their GED, and pursue higher education by age 19 or 20.

Eliminating the EITC, as suggested by Project 2025, would plunge 23 million Americans deeper into poverty, unraveling decades of progress in the fight against economic inequality.

Similarly, the Child Tax Credit, though not as expansive as the 2021 version, remains a vital tool in reducing poverty across the nation. In 2018 alone, the CTC lifted 4.3 million people out of poverty, including 2.3 million children, and alleviated poverty for an additional 5.8 million children. Restoring the expanded CTC, which achieved a historic 46% reduction in child poverty, is crucial. However, Project 2025 threatens to roll back these gains, pushing millions of families further into financial insecurity.

In addition to these potential cuts, Project 2025 proposes substantial tax breaks for the wealthy and corporations, including:

- The complete elimination of the 15% corporate minimum tax and the 1% excise tax on stock buybacks.

- A freeze on IRS funding allocated by the Inflation Reduction Act, which has enabled the agency to recover over $1 billion in unpaid taxes from the ultra-wealthy and significantly improve taxpayer services.

- A reduction in the number of income tax brackets and lower rates, disproportionately benefiting the ultra-wealthy while increasing taxes on working families. A study by the Center for American Progress found that a family of four with an annual income of $100,000 would face an additional $2,600 in taxes under this plan, while a similar family earning $5 million a year would receive a $325,000 tax cut.

These proposed changes highlight a broader strategy often employed by right-wing politicians: creating massive federal deficits through tax cuts for the wealthy and subsequently using those deficits as a pretext to slash programs that benefit low-income Americans.

The American public deserves transparency about the true implications of Project 2025. The devastating impact of its tax plan could have far-reaching consequences for our economy and the millions of Americans who rely on anti-poverty programs to make ends meet.

Join us in urging news networks across the country to shed light on Project 2025’s dangerous tax scheme. The time to act is now.

Add your name to call on news networks to expose Project 2025’s tax nightmare: